Transcript

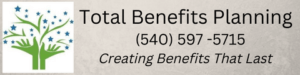

Imagine this circle represents all the money you’ll ever have. Your circle is bigger than some, and others are bigger than yours. But there’s one thing we all have in common when it comes to our circle of wealth and that is—we want it to grow.

Your circle of wealth consists of three types of money: accumulated money, lifestyle money, and transferred money.

Accumulated money represents the dollars you already have saved and those you are currently saving. To increase accumulated money the focus is usually on finding better investments that pay a higher return—often requiring you to assume more risk in the process.

Lifestyle money is what you spend to maintain your standard of living. In order to increase your wealth through lifestyle money, one naturally assumes that they will have to cut back and give up some of the luxuries they currently enjoy—and nobody wants that. Unfortunately, the thought of having to give up today to have tomorrow can keep people from taking action but there is another alternative.

This brings us to the third type of money we call Transferred money. Transferred money consists of money you may be transferring from your Circle of Wealth unknowingly and unnecessarily through taxes, interest, and non-deductible debt.

By far the most common strategy used to increase ones circle of wealth is to go on a financial diet and find investments with higher returns.

Our focus is to help you avoid the wealth transfers without you having to change your present lifestyle. To use a golf analogy, this is the equivalent of buying new clubs in hopes of improving your game. While it is important to have good clubs the greatest impact on your game will come from perfecting your “swing”. The reality is—it’s not the club—it’s the swing!

Suppose we were going to send you to play in the Masters golf tournament, golf’s most prestigious event. We have two things we can give you, you can choose one. You can have the clubs of any player who has ever played a round of golf or you can have their ability, which would you choose. Sure, you would want the “swing”.

What is it that the financial institutions deliver? Clubs or Swings? They have products which we are going to call the clubs. You have to have a club to play but having the correct swing is of more value. Having the correct swing financially means you have avoided any unnecessary wealth transfers making your money perform at it maximum potential doing all it can do.

Consider a family who makes one hundred thousand dollars a year and is able to save five thousand of that.

Let’s assume by selecting investments with higher risks they are able to increase their rate of return by two percent—which would be one hundred dollars in a year. In today’s world, that’s barely enough to buy a tank of gas.

On the other hand, if they can reduce their expenses by two percent by identifying money they are transferring unknowingly and unnecessarily, they would save an additional one thousand nine-hundred dollars in a year.

That’s the equivalent of increasing their rate of return on their savings by an incredible thirty-eight percent—ABSOLUTELY RISK FREE!

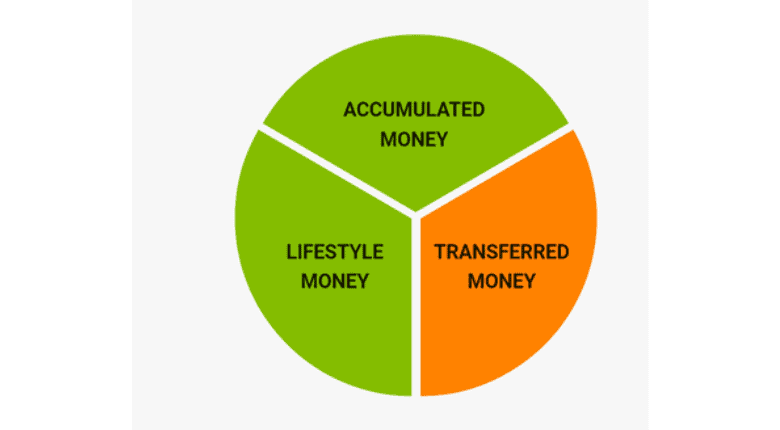

You see, focusing on increasing wealth through making more money or getting a higher return on investment is the equivalent of trying to fill a bucket with holes in it by pouring more water in—but would you ever do that? Of course not!

Plug the holes first and the bucket will fill up even if the flow is just a trickle. So how do you plug the holes in your financial bucket?

The best place to start is by eliminating unnecessary wealth transfers!

To do that, you must understand the strategies of the game just as you had to learn the strategies of tic-tac-toe before you started winning.

Unfortunately, most people rely on the financial institutions to teach them the strategies necessary to win the financial game.

This is like asking a fox to mind the henhouse.

They cleverly tell you the objective of the game while hiding the winning strategies. The sad truth is that by the time ones learns the strategies necessary to win they possibly have transferred away hundreds of thousands of dollars, unknowingly and unnecessarily.

We focus on helping you win the financial game. In fact, we are experts at it.

Your winning strategy begins by working with someone who is qualified at finding the holes in your financial bucket, plugging them, and increasing the flow into your bucket—all without assuming unnecessary risks or reducing your current standard of living.

Call for an appointment today. You’ll be glad you did!

Recent Posts

We are excited to announce a new series for 2024 entitled "Unconquered by Debt". The goal of this program is to enhance financial literacy and transform decision making so that individuals can...

What is the difference between a Financial Planner and a Financial Advisor

Often the terms "financial planner" and "financial advisor" are used interchangeably, yet they have different meanings and functions in the financial industry. In general, a financial advisor...